Pay Later for B2B

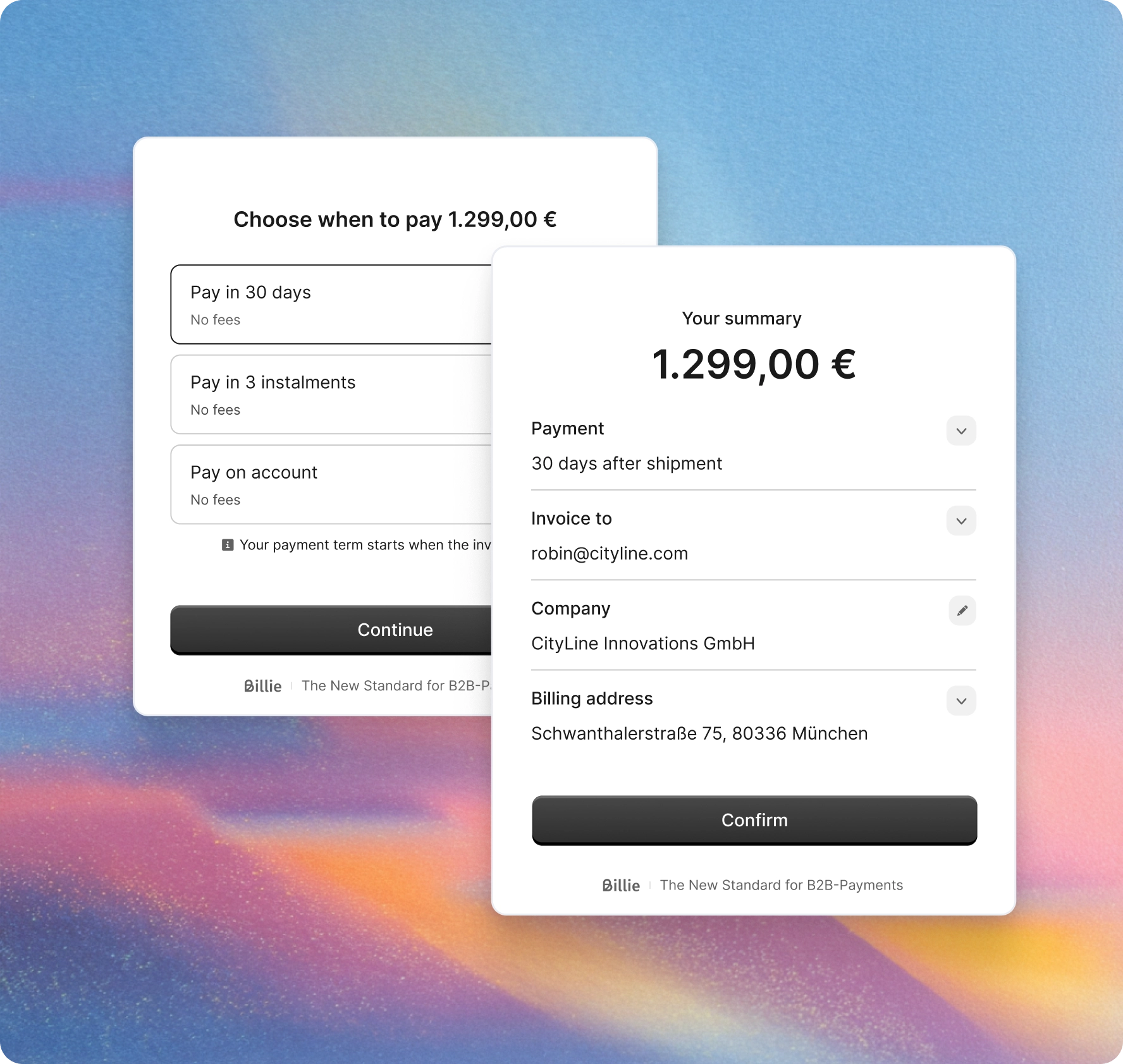

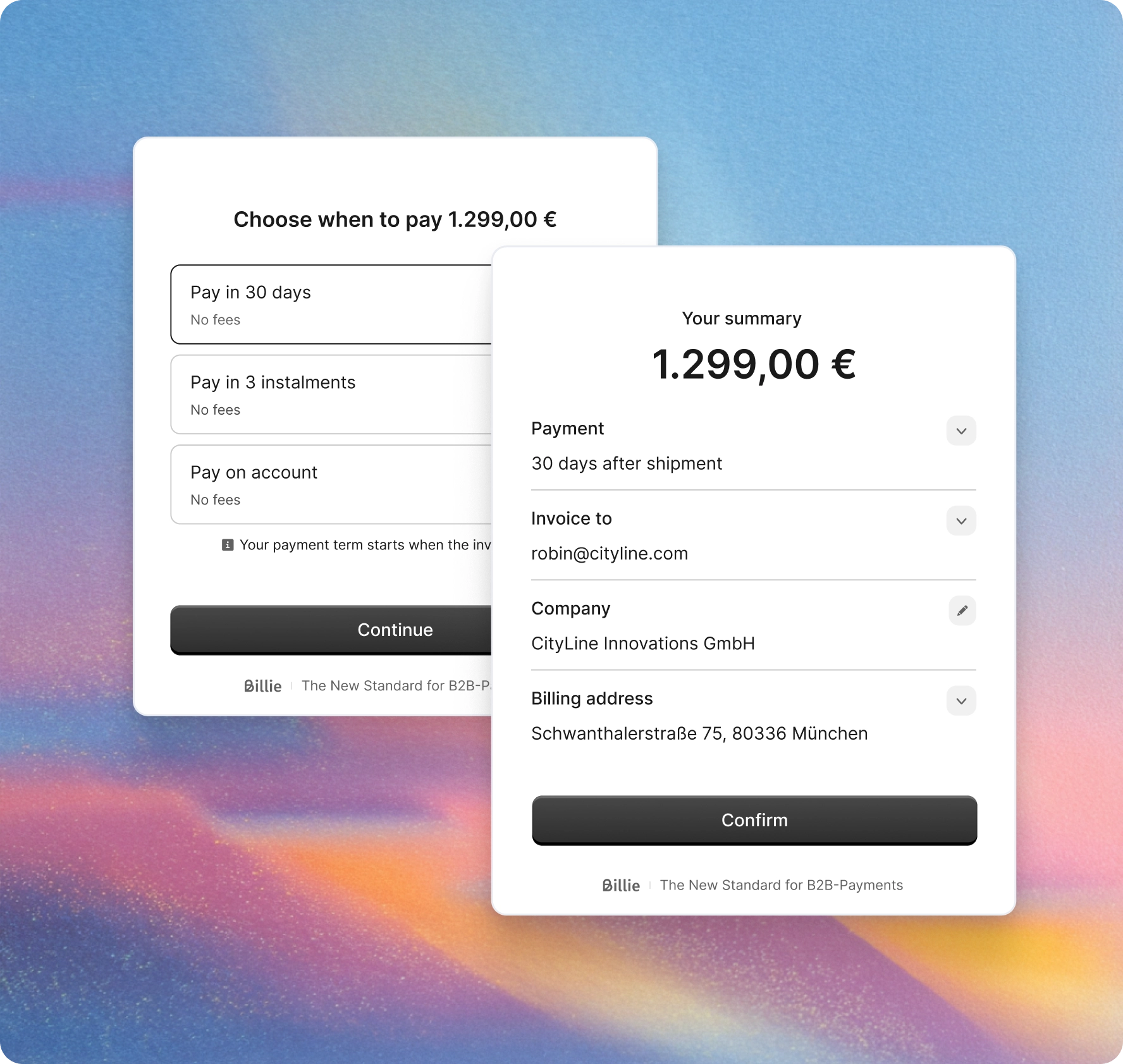

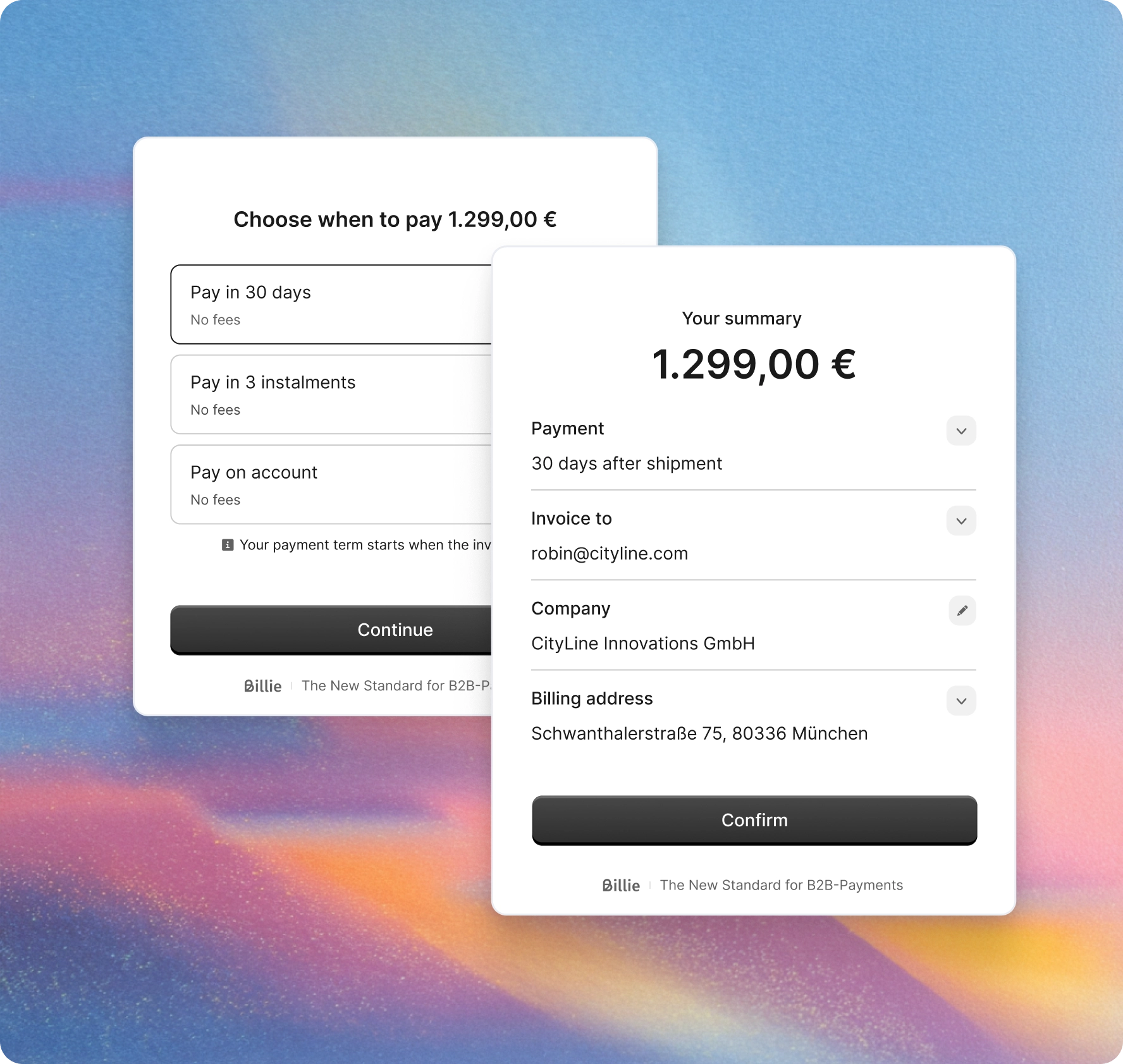

Flexible Terms for a Better Purchase Experience

Increase your revenue by offering business buyers their preferred payment method — frictionless, reliable, and with flexible terms.

B2B payments

Get more out of your B2B business

Average order value

+18%

Checkout conversion rate

+14%

Repurchase rate

+18%

Big in payments. Big in business.

Maximise your B2B sales, eliminate the risk

Elevate the buyer experience and remove payment friction for any business on any sales channel with instant credit acceptance and flexible terms. See your B2B sales grow while Billie assumes all credit and fraud risk, protecting you from payment defaults eating up your margin.

Strengthen cash flow — for you and your buyers

Simplify payment operations

The perfect match for B2B

That's why Billie is the right choice

High credit limits

Offer shopping limits tailored to business purchases of up to £1 million.

Omnichannel solution

Streamline Pay Later across channels and exceed your buyers’ expectations.

Direct access

Remove friction and make pay later terms instantly available without a sign-up needed.

Full-service suite

Stop chasing late payments and leave professional dunning and collections service to Billie.

Post-purchase support

Billie will take care of payment notifications and any buyer support requests.

Upfront payout

Let go of any liquidity constraints thanks to upfront payouts while your buyers enjoy more time to pay.

Stay up to date

Interested in learning more about Billie?

Sign up for our newsletter and get product updates and news about Billie directly into your inbox.