The New Standard for B2B Payments

Save time, boost sales, and scale with ease. With Billie—and modern payment solutions for B2B that make your buyers happy.

Made for your ambitions.

Our Products

Made to delight your customers

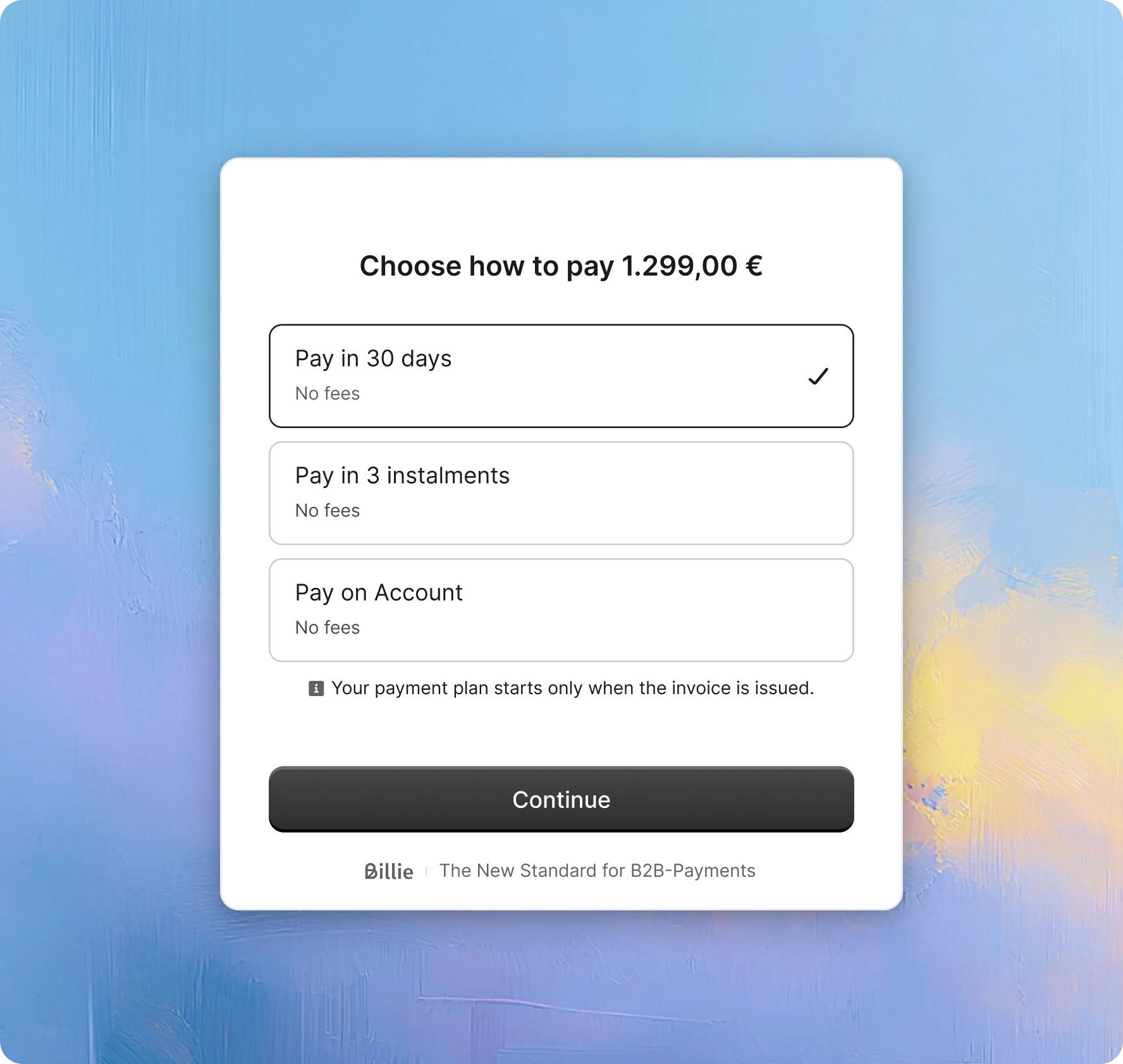

Pay Later

Get paid upfront while your buyers choose their preferred payment terms.

Pay in 3

Pay on Account

Omnichannel solution

Made for any channel

Chart new territories

Unlock the potential of cross-border trade and serve buyers across Europe.

+1 Million buyers

More than 1 million customers already use Billie for their business purchases across Europe.

+3 Billion Euro

Billie has already processed transactions with a total volume of more than 3 billion Euro.

+7,000 Active merchants

More than 7,000 merchants across the globe already partner and work with Billie, and counting.

Get started your way. Today.

Implement Billie using the integration option of your choice.

Stay up to date

Interested in learning more about Billie?

Sign up for our newsletter and get product updates and news about Billie directly into your inbox.